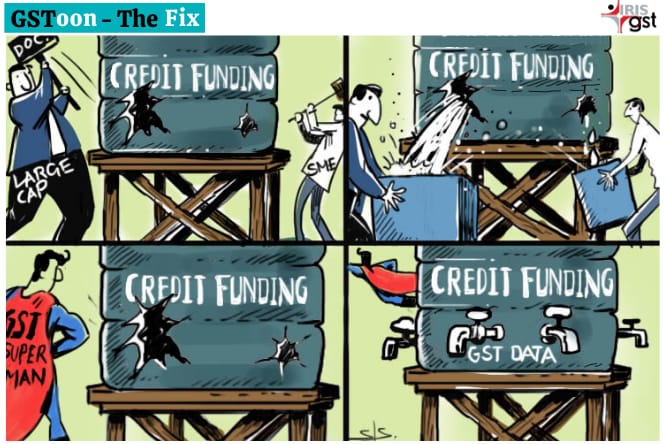

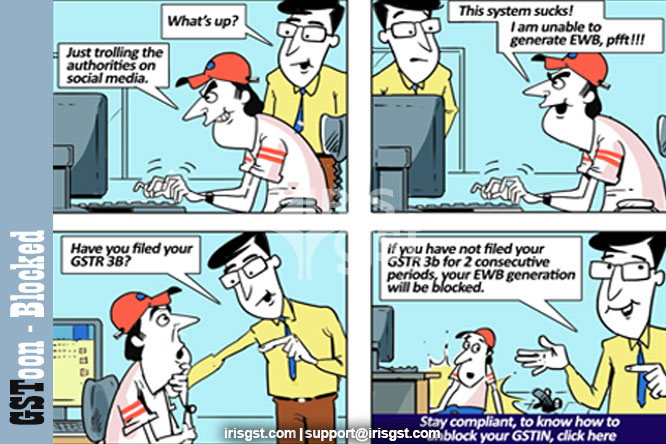

The F.R.I.E.N.D.S. Friends you are going to need in filing GST returns Here’s how we can help you: Credixo – Data based Lending Topaz – #EwayBill Management Sapphire –

GSToon Collection 2021

GSToon Collection 2020

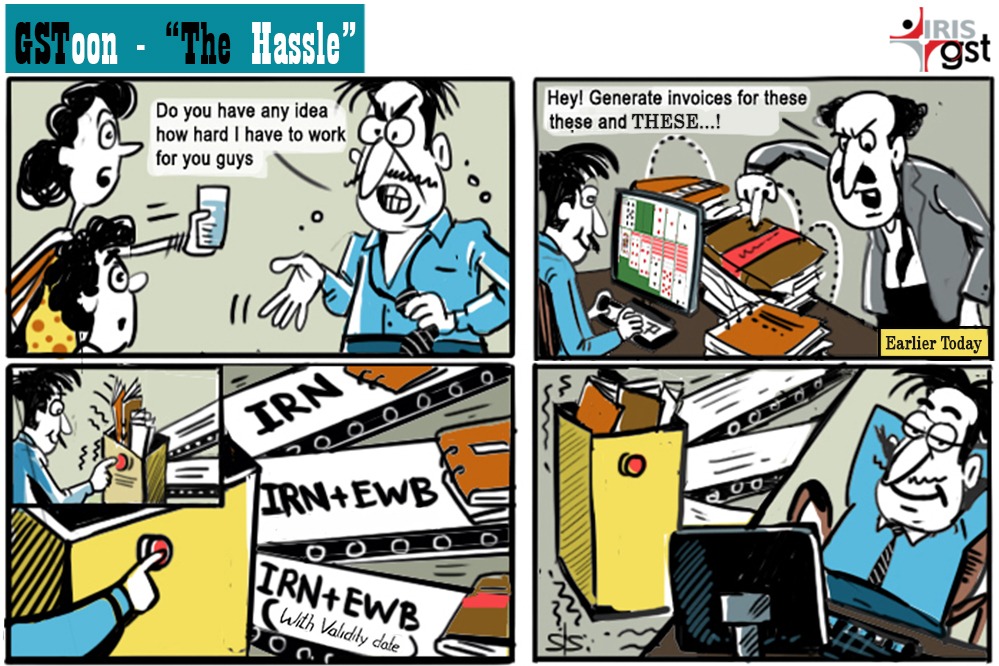

The hassle Importance of IRN in e-invoicing system With the introduction of IRN backed eInvoicing and EWB system, the government hopes to simplify the GST procedures and reduce the frauds

The Good News New GST Returns has been scrapped The #newGSTreturns has been scrapped by the government, considering the complications taxpayer will have to face while making the shift. Instead,

The Setback E-invoicing mandate in India The mandatory implementation of e-invoicing under GST was scheduled for April 1, 2020, however due to technical unavailability of the system; the same has

GSToon Collection 2019

Still awaiting your #Christmas present, wondering what could’ve delayed #Santa? Maybe this could help!To know more about NIL GST returns, read here.

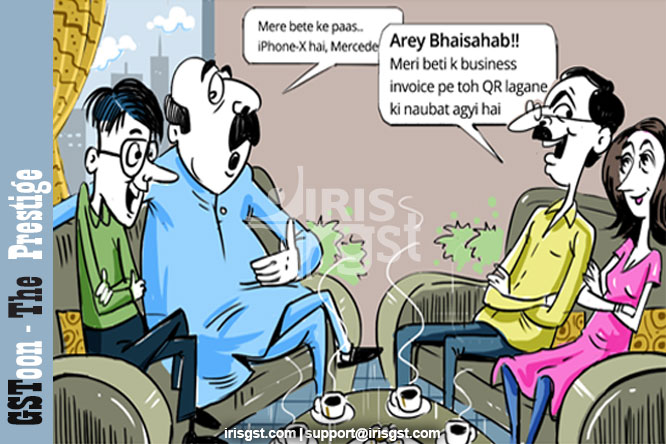

Under #e-Invoicing system, every #B2C invoice issued by taxpayer with an aggregate turnover of >500 crores has to have #QRcode on it.

E-Invoice generation is that it has to be generated through the #GST portal only !! In reality, any accounting software that can generate an invoice in the right format,can be used for eInvoicing.

GSTlympics Event 2