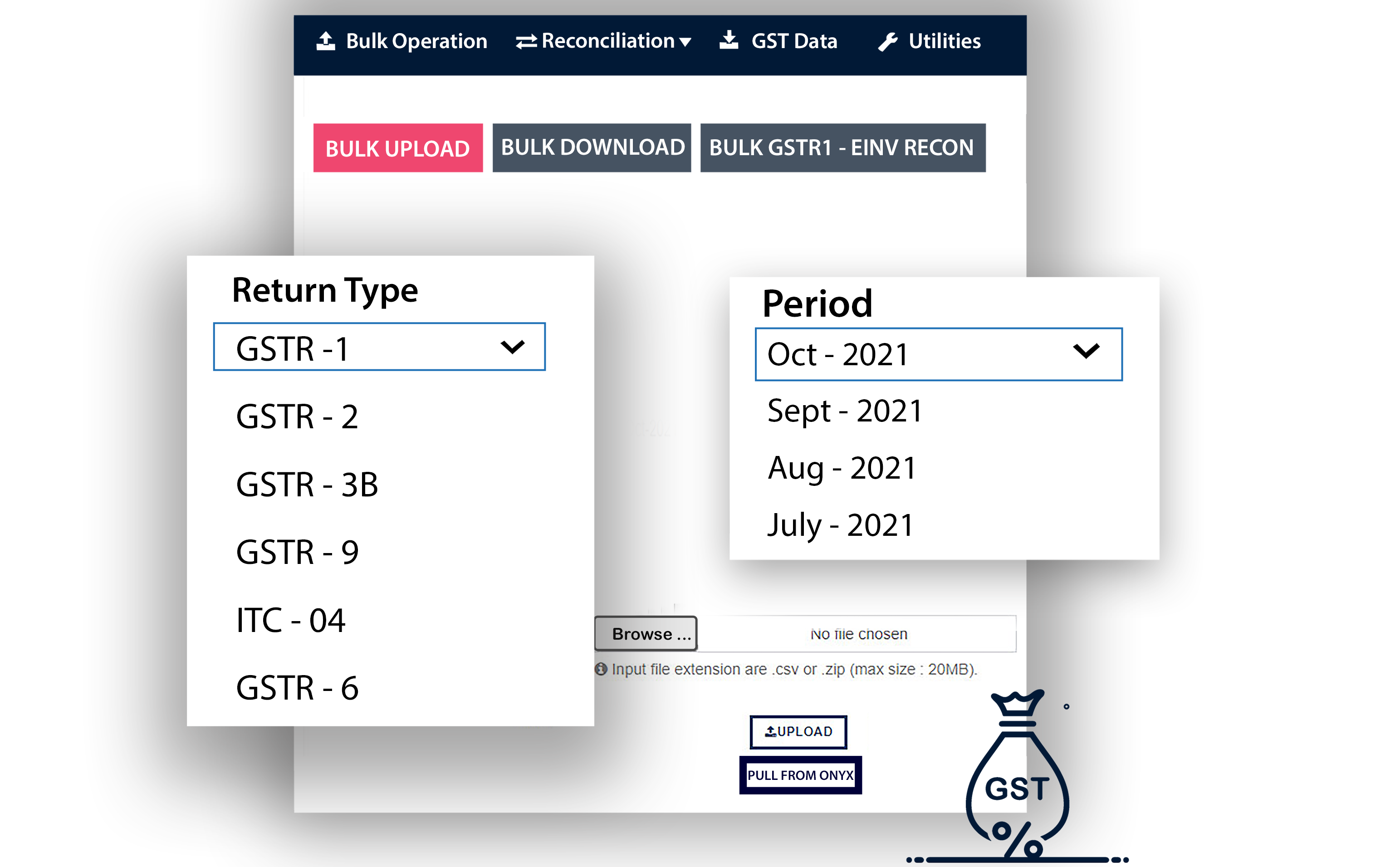

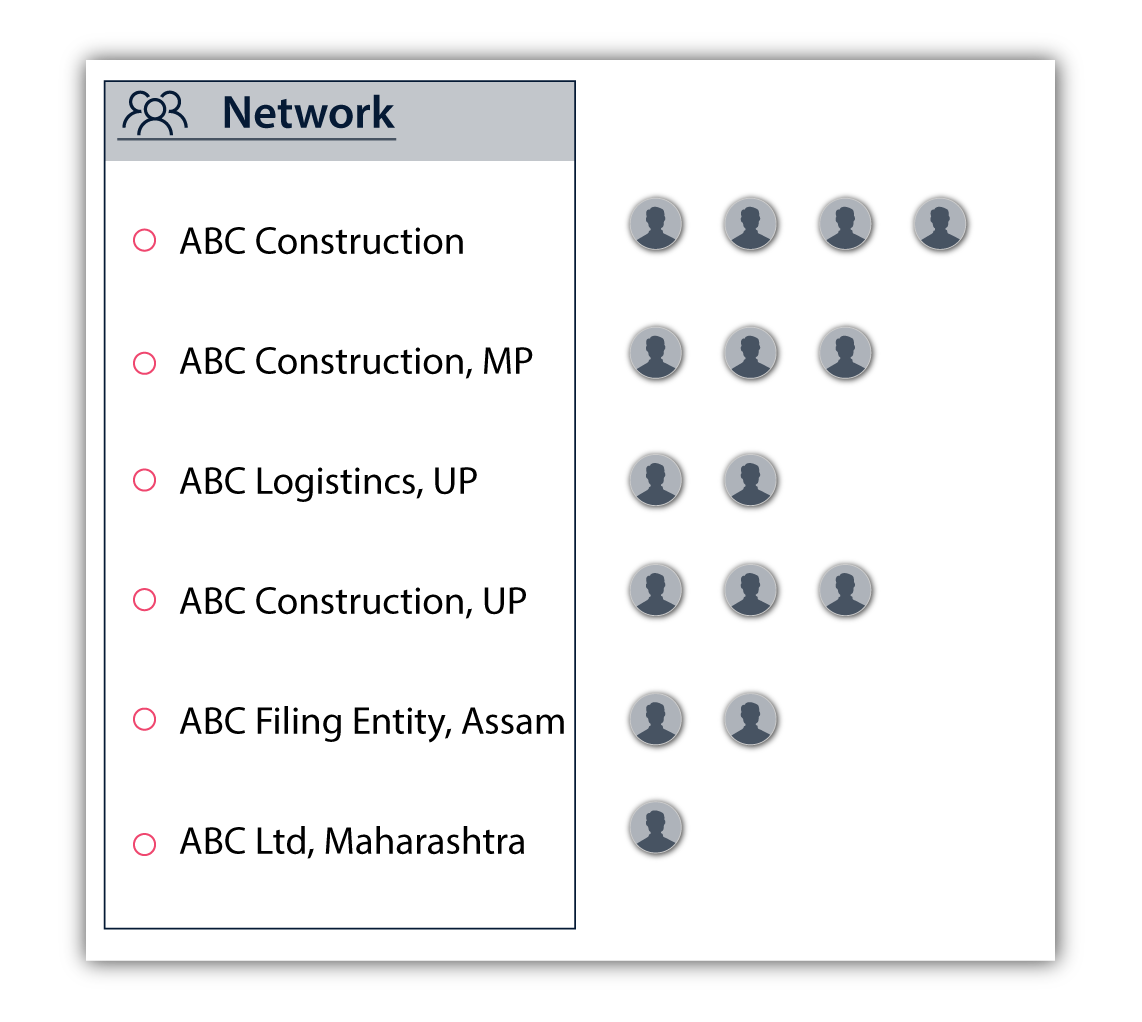

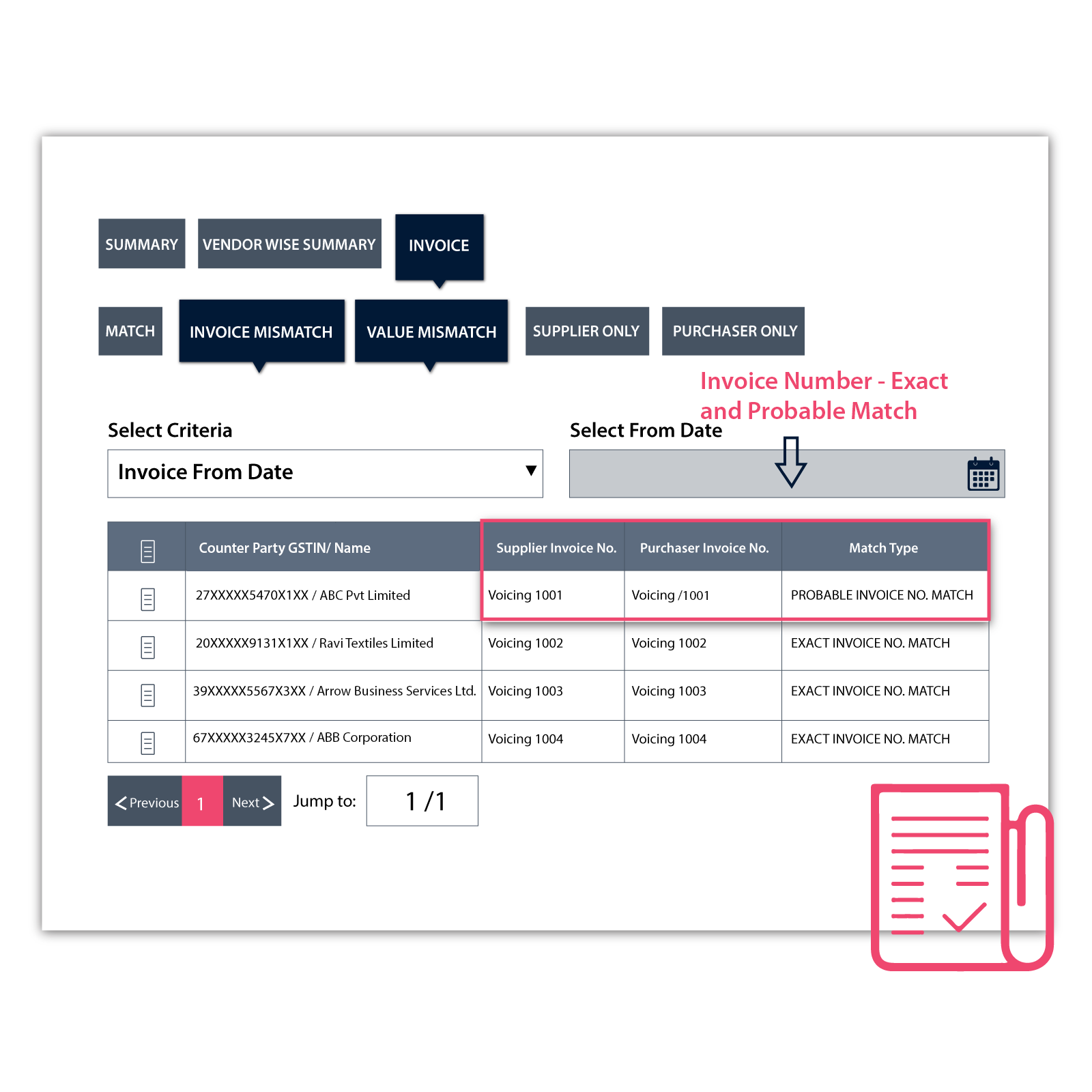

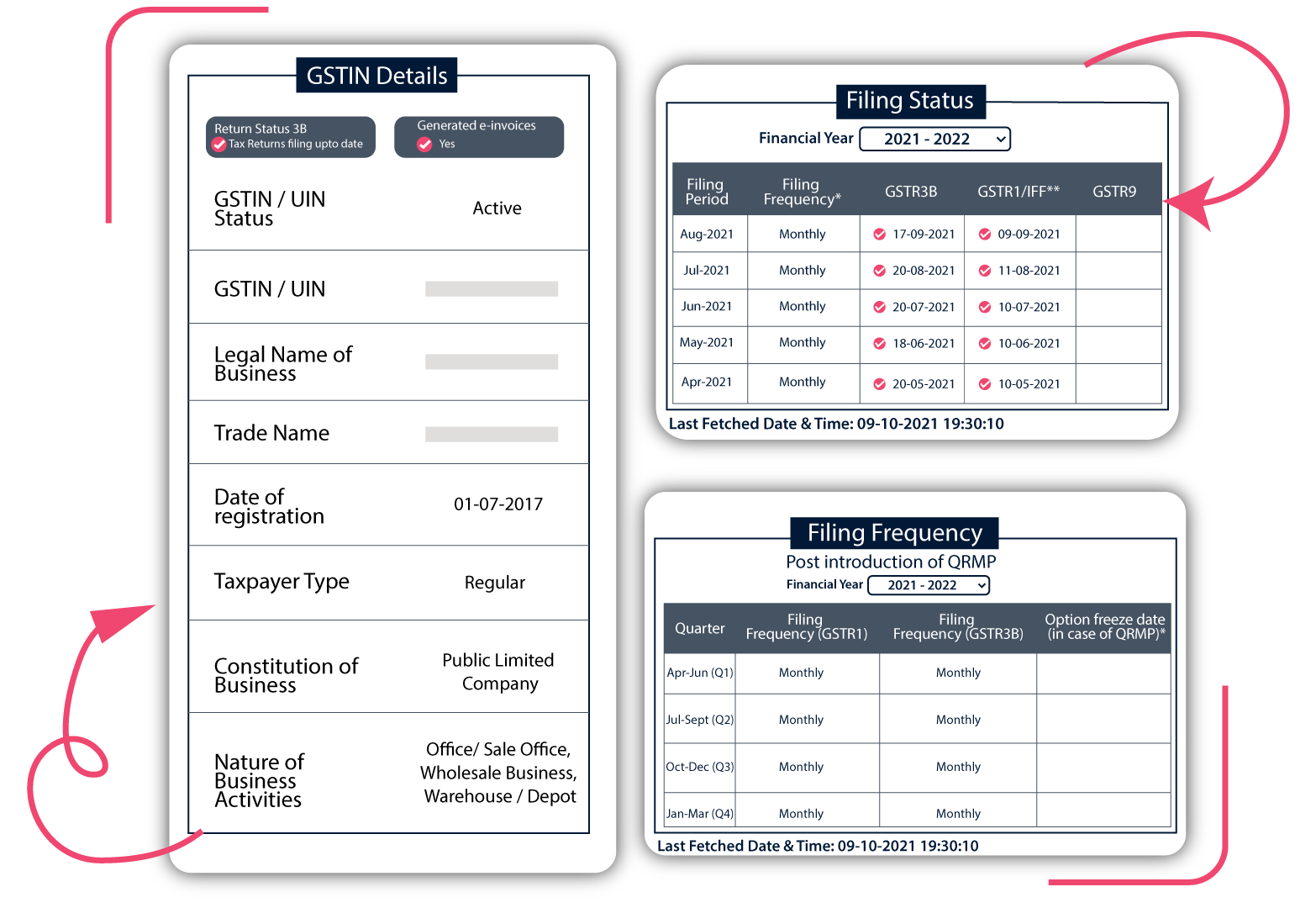

All in one powerful GST Solution for a seamless GST Return filing that supports multiple GST Return filing, PAN level data view, bulk operations, advanced 2A-Purchase Register reconciliation tool, vendor management and 100 % ITC Claims

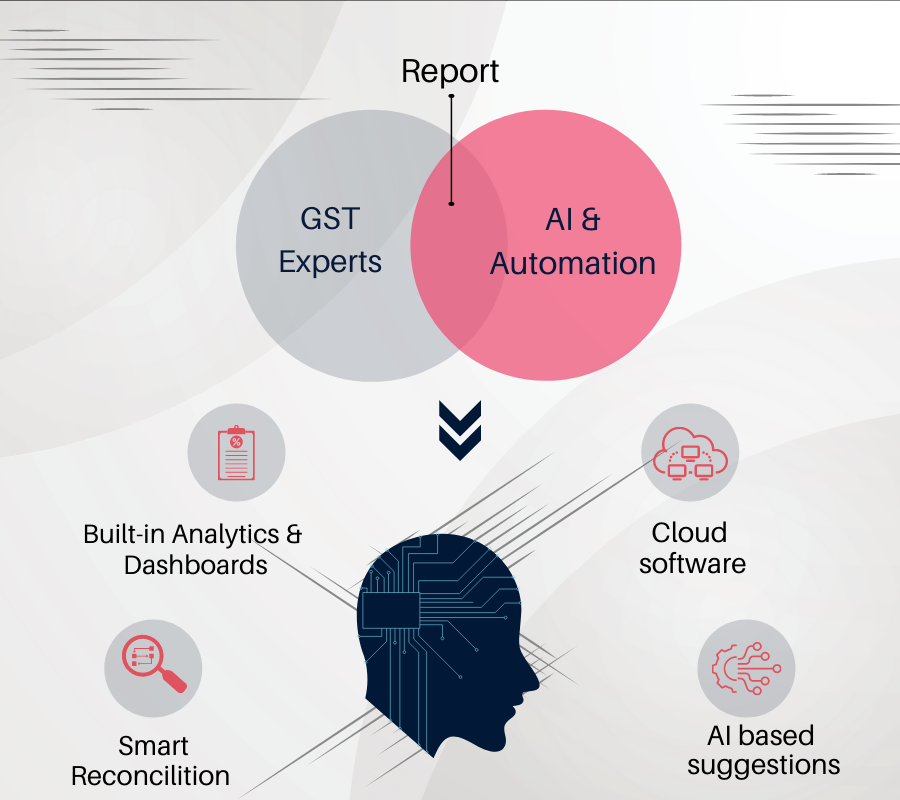

- Cloud-based Multi-user

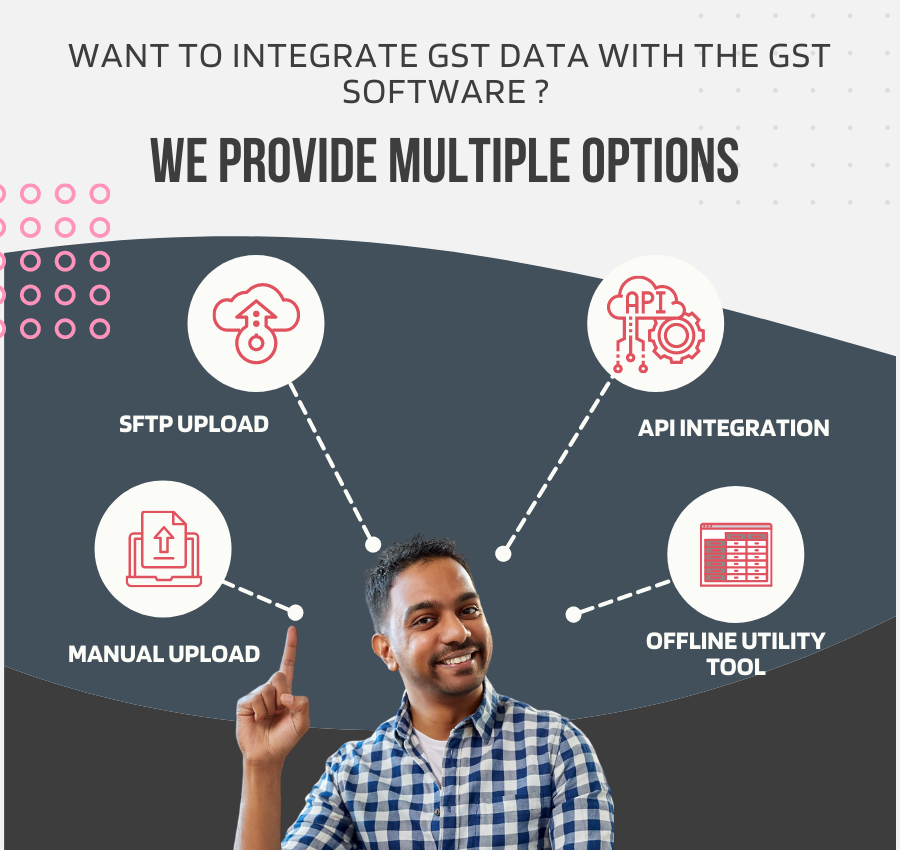

- ASP+GSP Solution

- Secure and Scalable

- Dedicated Customer Support

- Regular Upgrades

- Built-in Analytics & Dashboards