Year-end reconciliations are pivotal for businesses operating under the GST regime. Read to know the significance of filing GSTR-1 and GSTR-3B.

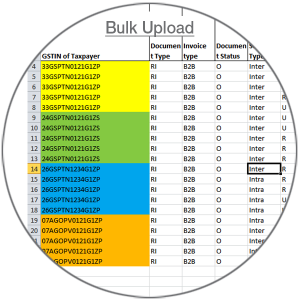

Upload purchase data for all your GSTINs in one go.

Upload purchase data for all your GSTINs in one go.

Download GSTR 2A from GST system for all your GSTINs simultaneously.

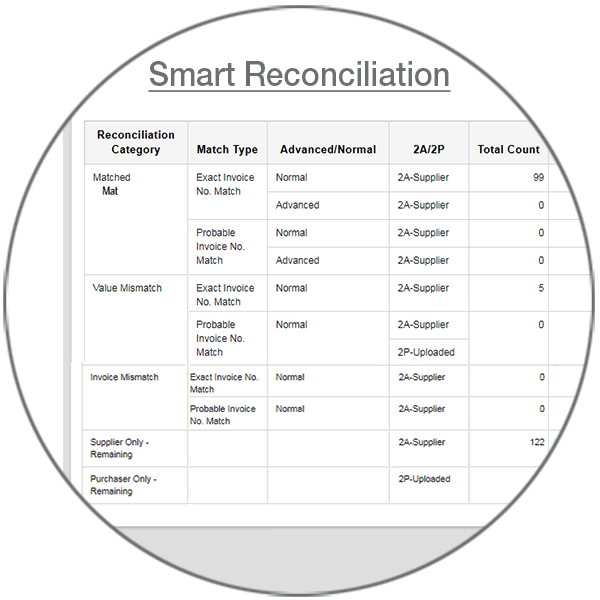

Automated Smart Reconciliation is performed to identify the comparable invoices and result of comparison is grouped into match, mismatch and missing invoices category

Mark the reconciled and reviewed invoices and generate a summary report to know the reconciliation status

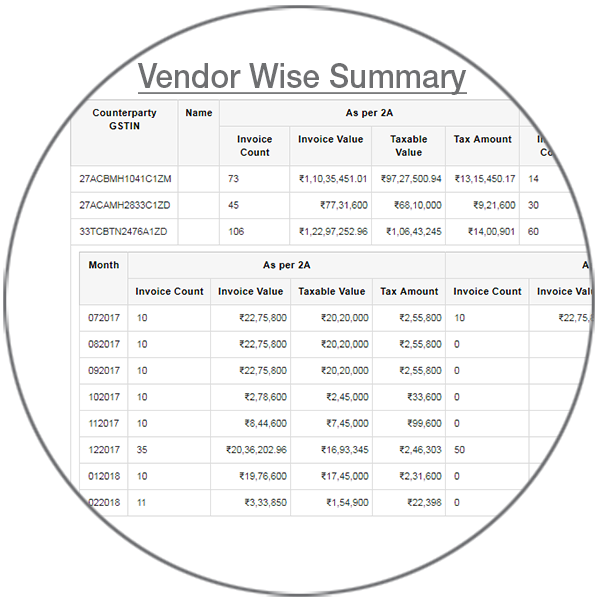

Get a vendor-level reconciliation result with break-up given month-wise

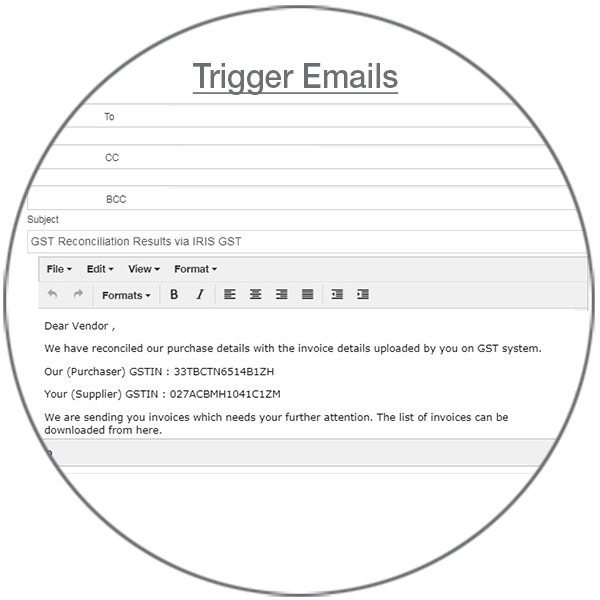

Trigger emails to vendors highlighting the invoices that need further action.

Match invoices from different financial years if invoice date, invoice value and taxable value are same.

Match invoice numbers for random character patterns to show probable matches.

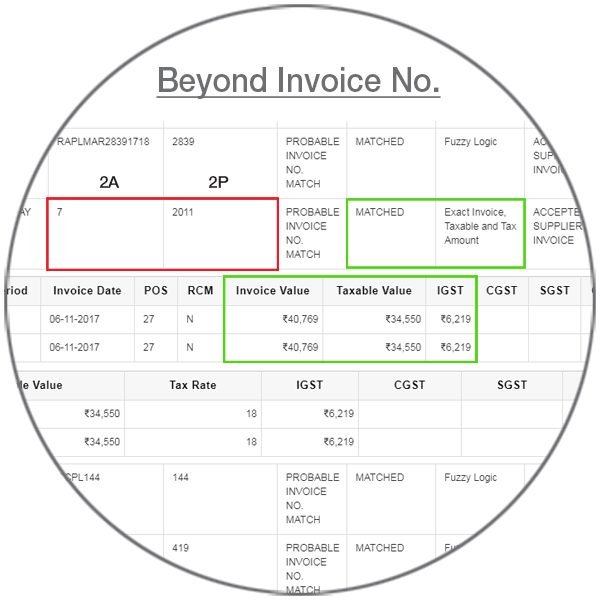

Reconcile beyond invoice number for matches in taxable value, invoice value and tax rate.

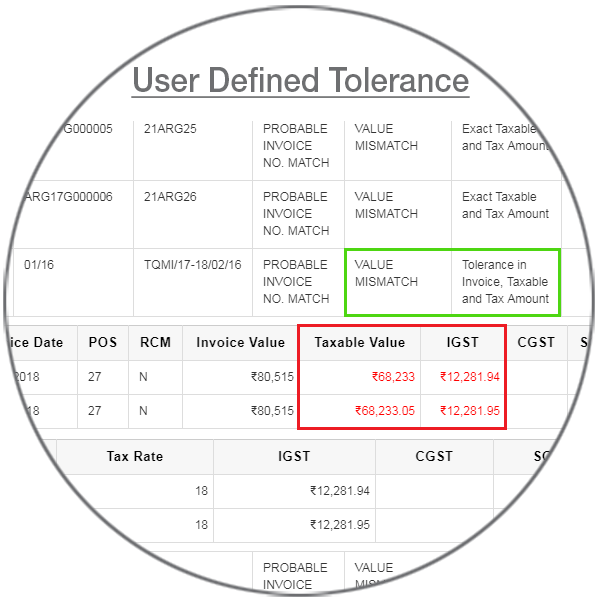

Match invoices for values across parameters like taxable value, invoice value and tax amount under user defined tolerance levels.

As a registered taxpayer, reconciling your purchase invoices with the supplier uploaded invoices on GST system is a critical activity as it determines your input tax credit (ITC) claim. Further, with Government issuing notices to taxpayers for the discrepancies in the ITC claimed in GSTR 3B and amount as per supplier uploaded details in GSTR 2A, it is necessary to reconcile data, follow up with counterparties and make adjustments and corrections in previously filed data.

The GST Reconciliation with IRIS Sapphire is efficient easy and time-saving. The Smart Reconciliation runs on the invoices uploaded by you and the auto-drafted details of GSTR 2A and categorizes the results as per the next actions required.

IRIS Sapphire covers all the possible scenarios of reconciliation from counter-party GSTIN match to invoice number and financial period match to give you more insightful and smarter reconciliation and buckets the differences into intuitive categories such as mismatch in values, missing invoices etc.

Year-end reconciliations are pivotal for businesses operating under the GST regime. Read to know the significance of filing GSTR-1 and GSTR-3B.

This article explores the pivotal role played by technology in simplifying ITC management, from automated data extraction and real-time reconciliation to seamless integration with accounting systems.

Checklist to maximize ITC Claim | ITC Claim under GST | GSTR 2B and GSTR 2A | Role of GSTR 2B in ITC Claim | ITC Maximization | Read more

CBIC has issued a GST circular no 183/2022 clarifying the procedure to be followed for dealing with the difference in ITC availed in GSTR-3B as compared to that detailed in GSTR-2A for FY 2017-18 & 2018-19

ITC Computation is fundamental for businesses to ensure maximum ITC claim as it can help have more working capital. In this article, we will discuss 4 key aspects of ITC computation in detail.

The ultimate objective of every taxpayer is to maximize ITC claim while following all the conditions and rules of GST law. The success of this goal depends on the internal practices and tools used and some external factors such as vendor compliance. Here, we discuss, 4 important aspects to maximize ITC claim.