ABOUT US

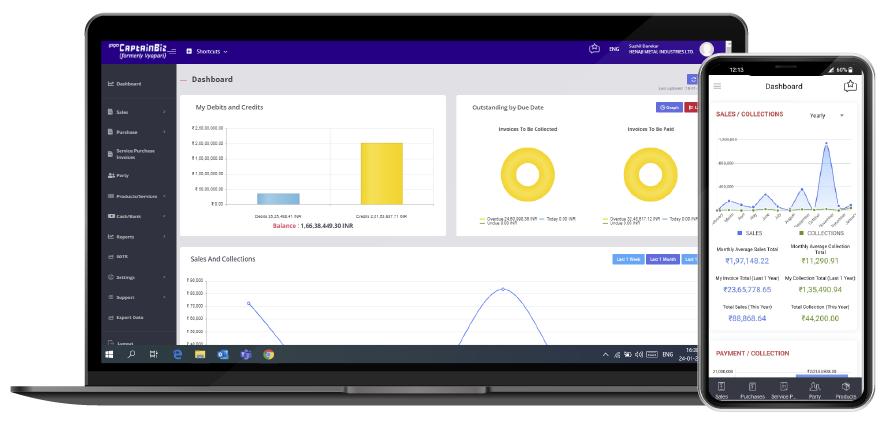

CaptainBiz is a sales and purchase invoice management solution with the power of mobile and in-built GST compliance tailored to the unique needs of small and micro businesses in India!

The application instantly records all business transactions like

purchases, sales, collections, and payment transactions. It gives

a complete overview of the business and helps the business owner

effectively manage their time and focus on growth and profits.

FEATURES

Smooth Business. Smooth Life.

invoices via whatsapp, email.

adjust stocks in case of surplus or deficits

cash cycle

inventory management

transactions and outstanding

auto-updated as the transactions are recorded

formats

reports help manage business effectively

business in a single account

equivalents, and bank accounts.

company accounts on the app

account

PRICING

Simple pricing plans. One for every size of company.

1 Month plan

Tez

₹ 699

Issue purchase / sales invoice

Issue purchase / sales invoice

14 Days Free Trial

14 Days Free Trial

Order tracking

Order tracking

Editing a self-employment receipt

Editing a self-employment receipt

Current account tracking

Current account tracking

Collection and payment tracking

Collection and payment tracking

Cash and bank transaction tracking

Cash and bank transaction tracking

Inventory tracking

Inventory tracking

Customer check entry

Customer check entry

Customized invoice template

Customized invoice template

Android and iOS mobile use

Android and iOS mobile use

1 Year plan

Copper

₹ 4999

Issue purchase / sales invoice

Issue purchase / sales invoice

14 Days Free Trial

14 Days Free Trial

Order tracking

Order tracking

Editing a self-employment receipt

Editing a self-employment receipt

Current account tracking

Current account tracking

Collection and payment tracking

Collection and payment tracking

Cash and bank transaction tracking

Cash and bank transaction tracking

Inventory tracking

Inventory tracking

Customer check entry

Customer check entry

Customized invoice template

Customized invoice template

Android and iOS mobile use

Android and iOS mobile use

2 Year plan

Silver

₹ 7999

Issue purchase / sales invoice

Issue purchase / sales invoice

14 Days Free Trial

14 Days Free Trial

Order tracking

Order tracking

Editing a self-employment receipt

Editing a self-employment receipt

Current account tracking

Current account tracking

Collection and payment tracking

Collection and payment tracking

Cash and bank transaction tracking

Cash and bank transaction tracking

Inventory tracking

Inventory tracking

Customer check entry

Customer check entry

Customized invoice template

Customized invoice template

Android and iOS mobile use

Android and iOS mobile use

3 Year plan

Recommended

Gold

₹ 11999 + GST

Issue purchase / sales invoice

Issue purchase / sales invoice

14 Days Free Trial

14 Days Free Trial

Order tracking

Order tracking

Editing a self-employment receipt

Editing a self-employment receipt

Current account tracking

Current account tracking

Collection and payment tracking

Collection and payment tracking

Cash and bank transaction tracking

Cash and bank transaction tracking

Inventory tracking

Inventory tracking

Customer check entry

Customer check entry

Customized invoice template

Customized invoice template

Android and iOS mobile use

Android and iOS mobile use

5 Year plan

Platinum

₹ 19999 + GST

Issue purchase / sales invoice

Issue purchase / sales invoice

14 Days Free Trial

14 Days Free Trial

Order tracking

Order tracking

Editing a self-employment receipt

Editing a self-employment receipt

Current account tracking

Current account tracking

Collection and payment tracking

Collection and payment tracking

Cash and bank transaction tracking

Cash and bank transaction tracking

Inventory tracking

Inventory tracking

Customer check entry

Customer check entry

Customized invoice template

Customized invoice template

Android and iOS mobile use

Android and iOS mobile use

10 Year plan

Diamond

₹ 39999 + GST

Issue purchase / sales invoice

Issue purchase / sales invoice

14 Days Free Trial

14 Days Free Trial

Order tracking

Order tracking

Editing a self-employment receipt

Editing a self-employment receipt

Current account tracking

Current account tracking

Collection and payment tracking

Collection and payment tracking

Cash and bank transaction tracking

Cash and bank transaction tracking

Inventory tracking

Inventory tracking

Customer check entry

Customer check entry

Customized invoice template

Customized invoice template

Android and iOS mobile use

Android and iOS mobile use

GO DIGITAL WITH CaptainBIZ

- 01 Pre-Accounting

Separate your daily business operations from general accounting requirements with CaptainBiz.

- 02 User Friendly

With its user-friendly design, you can perform all your pre-accounting transactions in seconds and easily access your past records.

- 03 Access from Mobile and Desktop

Generate your invoices quickly and easily from wherever you have internet access and follow the collection/payment transactions with your customers/suppliers.

- 04 Ready to Use

Register by providing minimal details and system will be ready to be used in time span of few minutes.

- 01 Pre-Accounting

Separate your daily business operations from general accounting requirements with CaptainBiz.

- 02 User Friendly

With its user-friendly design, you can perform all your pre-accounting transactions in seconds and easily access your past records.

- 03 Access from Mobile and Desktop

Generate your invoices quickly and easily from wherever you have internet access and follow the collection/payment transactions with your customers/suppliers.

- 04 Ready to Use

Register by providing minimal details and system will be ready to be used in time span of few minutes.

TESTIMONIALS

FREQUENTLY ASKED QUESTIONS

How can we help you?

How can I reach to support team?

Please contact us at

- Email- support@captainbiz.com

- Phone number- 022-61054690

Is the software Offline?

No, It’s a cloud based application, which can be accessed remotely from any location.

What happens when my trail period ends?

When the trail ends, the data remains intacts and user can subscribe to paid version to continue with exiting data.