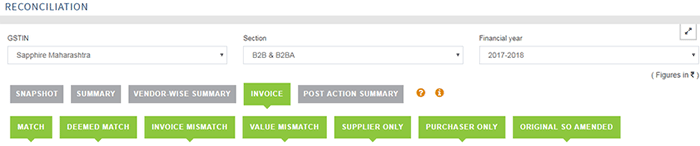

Invoice reconciliation

In this reconciliation, process actions are allowed to take. And based on actions taken your final reconciliation report will get created.

Now let’s see seven categories in which invoices will get categorized and actions allow for those seven categories:

1. Match Category – GSTR 2A data matching with Uploaded data (2P)

2. Deemed Match Category – Within tolerance difference invoices deemed as match

3. Invoice Mismatch – Mismatch only in invoice level details like POS, Reverse charge, Invoice type

4. Value Mismatch – Mismatch in values like taxable value, tax values

5. Supplier only – Additional GSTR 2A invoices for which no comparable invoice found in uploaded invoices (2P)

6. Purchaser only – Additional uploaded invoices (2P) invoices for which no comparable invoice found in GSTR 2A

7. Original supplier only Amended – These are original invoices ignored and it’s amended invoice considered in reconciliation.