Based on recent notification 39/2021 and 40/2021, From Jan 2022 onwards, you can claim ITC on basis of GSTR 2B only. Hence now it is important to track invoices for which you can claim the ITC. Also Jan 2022 onwards, you can not claim the ITC on a provisional Basis.

So on basis of these new changes in rules, the Feature of ITC 3B marking got updated in IRIS Sapphire as well.

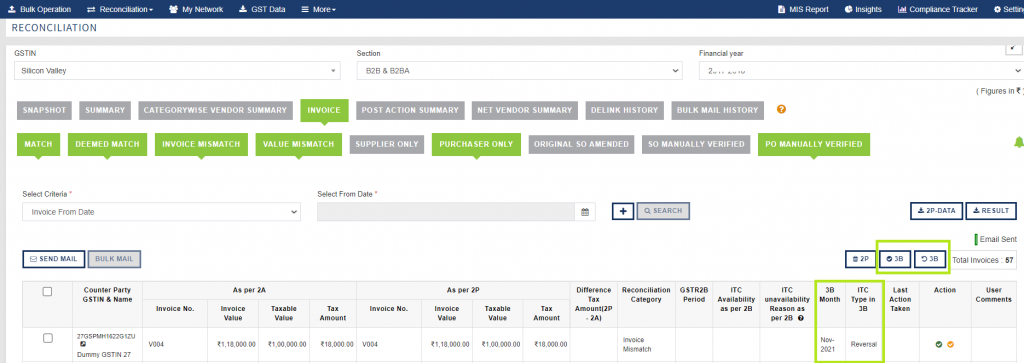

To track 3B ITC marking, the option is available under the Reconciliation module in all the categories (Except Supplier only categories) i.e. “Mark 3B ITC” & “Reset 3B Marking”

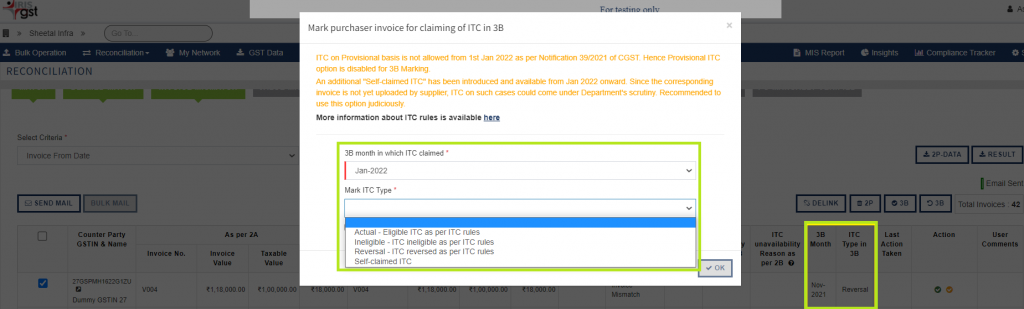

Mark 3B ITC:- You need to select invoices on which you want to claim the ITC. Click on “Mark 3B ITC”. One dialog box will open where you have to select the month in which you want to claim ITC in 3B and Also select the type of ITC.

This facility you can use at a bulk level as well as invoice level as well.

A bulk facility will help you to mark multiple invoices in one go.

Below are the Various ITC marking types:

- Actual – ITC being claimed for the month selected. Please ensure conditions for ITC such as use for business purpose, actual receipt of goods and services etc. are satisfied

- Ineligible – ITC which cannot be claimed as per ITC rules

- Reversal -ITC which was claimed in earlier months for the invoices and is to be reversed in selected month

- Self-claimed ITC – This is a new ITC type marking and it will be available from Jan 2022 onwards. The meaning of this type is “This is a residual category and should be applied cautiously. Such ITC could be subject to scrutiny by Department and hence if being claimed, taxpayers are advised to have proper documentation and reasoning to support this case.”

- Provisional – This ITC type is allowed till Dec 2021 only. As of now we know that based on notification 40/2021, ITC is allowed to be claimed when it will get reflected in GSTR 2B. Hence from Jan 2022 onwards, ITC marking as provisional is not allowed. So as per rule till Dec 2021, this provisional ITC marking is allowed.

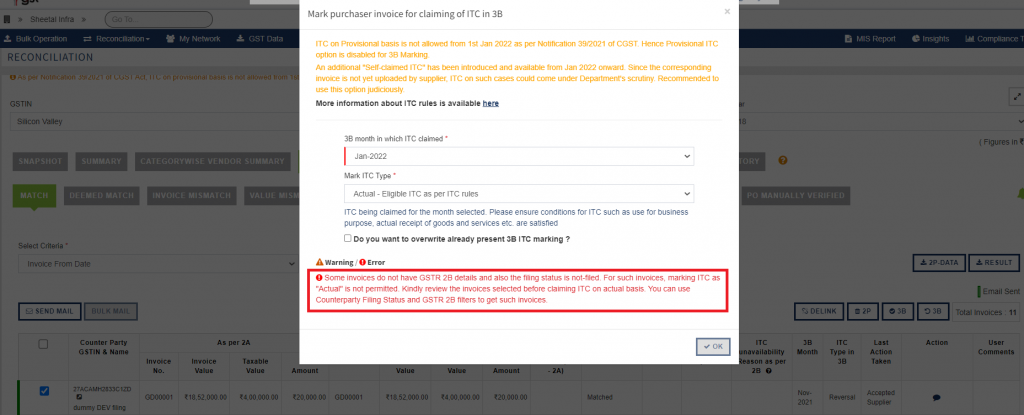

Also as this ITC tracking action is strictly needed and proper marking should happen hence we added some errors/warnings, which can guide a user to take the corrective action. Also kindly note that these errors/warnings are added from Jan 2022 period onwards.

The error message will be provided in the below case and here “Actual” 3B marking type is not allowed to be marked for invoices:

Case – If the invoice has counterparty filing status as “N” (No), Also 2B flagging is not present and 3B marking type is selected as Actual then the system will show the error message as “Some invoices do not have GSTR 2B details and also the filing status is not-filed. For such invoices, marking ITC as “Actual” is not permitted. Kindly review the invoices selected before claiming ITC on actual basis. You can use Counterparty Filing Status and GSTR 2B filters to get such invoices.”

Warning messages will come in the below cases:

Case 1 – Counterparty filing status is Y but 2B flagging is not present.

Here 3B marking will be allowed but the warning message will come. This warning will indicate the user to kindly GET and Update 2B details in the reconciliation.

Case 2 – Counterparty filing status is N but 2B flagging is present.

Here 3B marking will be allowed but the below warning message will come. This warning will indicate the user to kindly reget 2A details so that counterparty filing status will get updated in reconciliation

Case 3 – This case is specific to the purchaser-only category. ITC marking selected other than Self-claimed ITC

Now Jan 2022 onwards, for the purchaser only invoices only self-claimed 3B ITC marking type is allowed. As the invoice is lying in a purchaser-only category it means the reconciliation for this invoice is not yet final and corresponding supplier invoices in 2A/2B are not present. Hence as per law, the actual taxpayer can not claim ITC on such invoices. But there may be a possibility of some practical challenges and because of that taxpayers want to claim the ITC hence we are allowing the “Self-claimed ITC” flag for such invoices.

In case of multiple reconciliation categories are selected like Match category selected along with purchaser only category and 3B marking type is selected other than self-claimed ITC then we are providing one warning message like “For Purchaser only category, ITC mark type other than Self -claimed ITC is not allowed”.

This means, marking for match invoices will happen but marking for the purchaser only invoices will not happen because ITC marking type is selected other than Self-claimed ITC.

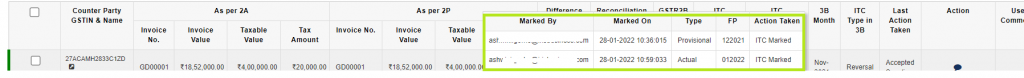

Invoice Level – 3B ITC Tracking History Trail

In addition to the above, now 3B tracking history trail is also available under reconciliation view. If you go on 3B month or ITC Type then you can see the ITC tracking trail for that particular invoice.

3B tracking status:

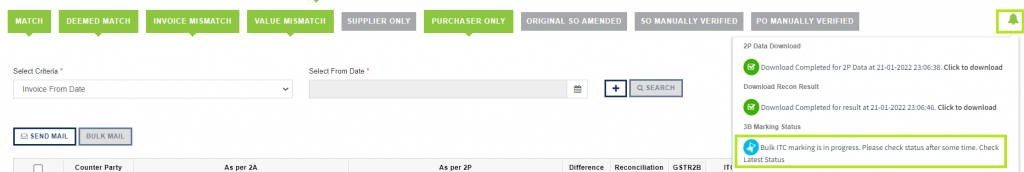

Now count for how many invoices 3B marking is completed is also available.

Filter Facility :

Based on the 3B-month marking and 3B ITC marking type, a filter facility is also available. Also now additionally one ITC grouping filter is provided. By using this filter you can easily filter out such invoices which are allowable to claim ITC. And by using this group filter you can do bulk 3B marking and it means it will save your time of processing.

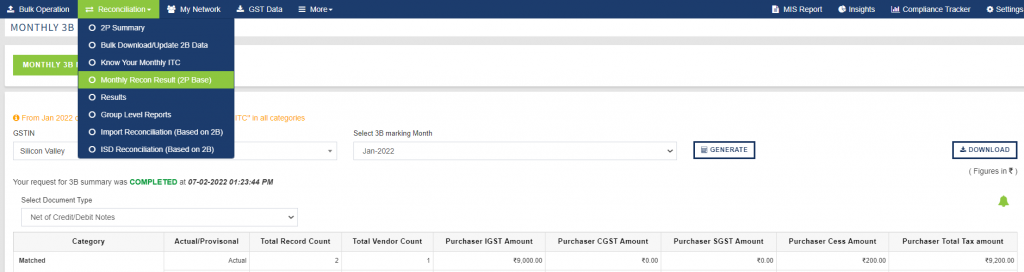

Report based on 3B marking is also available under the Monthly recon result (2P base) page.

Purpose of Feature :

By using this feature of ITC marking, it will ease your ITC calculation for GSTR 3B purpose. It will also help you to track each invoice from a future point of view. If any notices come from the government then by looking at the 3B marking and month mapping you can easily get to know the bifurcations and justifications that you can provide to the notices.