The central government vide Notification no 49/2019 central tax dated 9/10/2019 has made amendments to CGST Rules, 2017. One of the amendments is insertion of sub-rule (4) to rule 36 which is reproduced as follows: Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers in GSTR-1 ( and consequently does not appear in GSTR-2A) under sub-section (1) of section 37, shall not exceed 20 per cent of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of section 37.’

After the insertion of this sub-rule, the reconciliation of GSTR-2A and invoices has become mandatory to find out the Input tax credit to be availed for each month. This results in a workload to the tax-payer / practitioners/professionals to reconcile the GSTR-2A each month.

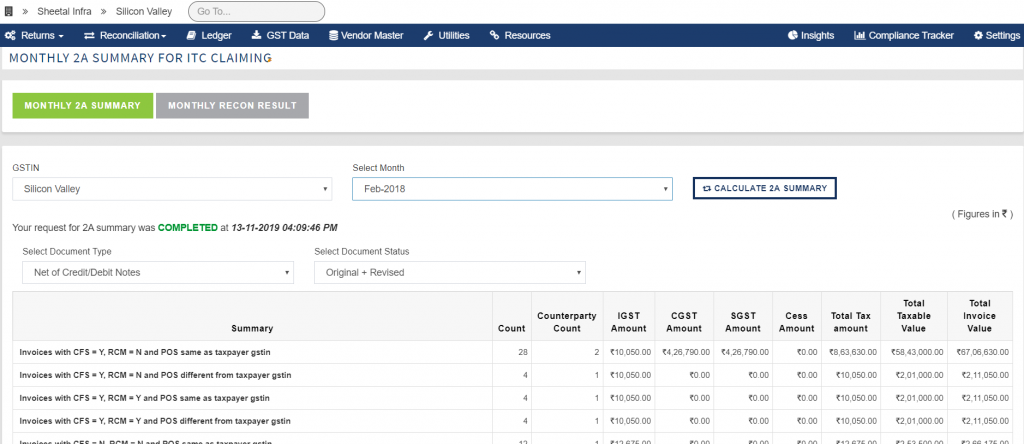

So to help you in reconciliation and deciding your monthly ITC, we are providing 2A report i.e. “Know your monthly ITC” with reconciliation results.

To read more about process of using this report i.e. Know Your Monthly ITC, please click here

For queries or a detailed demo, contact us or write to us at support@irisgst.com