To view GSTR 2A summary, select GSTIN and Filing Period and click on Calculate 2A summary

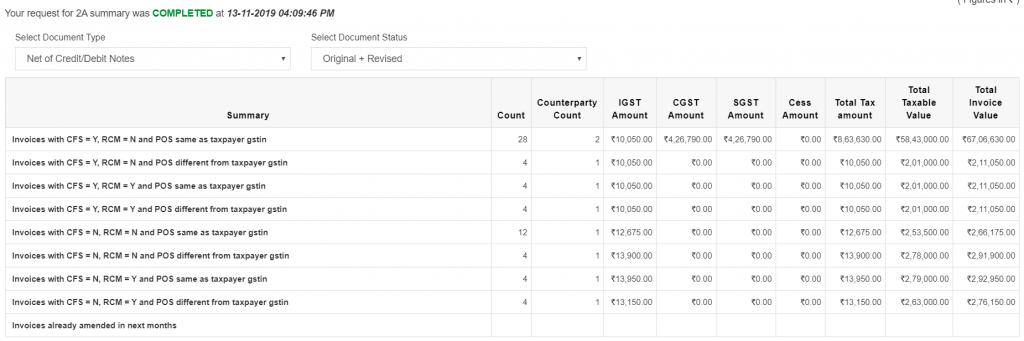

Once the calculation request completed, you can select document type like net debit and credit notes, regular invoices, credit notes and debit notes and Document status like original, revised and Original + Revised.

Here 2A values will get bifurcated between different conditions i.e. based on Counterparty filing status (CFS = Y / N), Reverse charge mechanism (RCM = Y / N) and Place of supply (POS).

As per GSTN calculations, CFS =Y, RCM =N and POS is same as taxpayer GSTIN is the combination for eligible ITC.

Also to know invoices already amended in next month, you need to run advance reconciliation rule i.e. “Reconcile Amended Supplier Only Invoices with Original Purchaser Invoices“.

So by using this report, you can decide how much ITC is available to you.