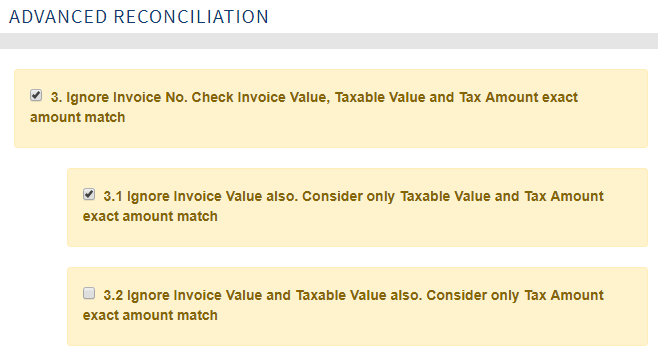

Rule 3.1 Ignore Invoice Value also. Consider only Taxable Value and Tax Amount exact amount match

This option will be available only when the main rule i.e. Rule 3 is selected. This will check if invoices are comparable ignoring invoice no. and invoice value and considering the month of the invoice date in both purchaser only and supplier only invoice.

So the basis of comparison will be based upon:

Counterparty GSTIN

Exact taxable value and tax values matching at the invoice level

Document financial period (i.e. month and year based on invoice date)

E.g. Invoice C1001 as per GSTR 2A i.e. Supplier records and Invoice D1001 as per Purchaser record but the taxable amount, the month-year combination of invoice date and tax values and counterparty GSTIN are exactly matching for these two invoices.

Then these two invoices will get reconciled and will move to the value mismatch category.

If more than one invoice found for comparison then the application will move anyone to Value mismatch /Invoice mismatch category.