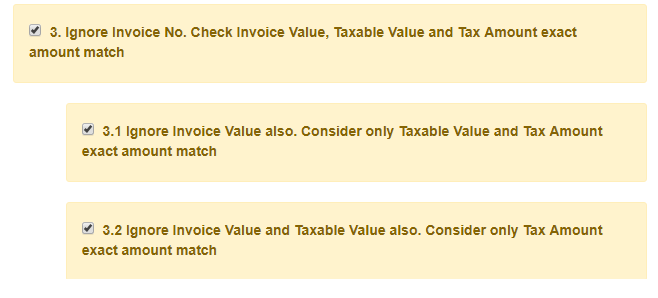

Rule 3.2 Ignore Invoice Value and Taxable Value also. Consider only Tax Amount exact amount match

This option will be available only when main rule 3 is selected. If this option is selected then Rule 3.1 will also be automatically selected and run. This will check if invoices are comparable ignoring invoice no., invoice value and taxable value and considering exact tax amount and the month of the invoice month in both purchaser only and supplier only invoice.

So the basis of comparison will be based upon:

Counterparty GSTIN

Exact tax values matching at invoice level

Document financial period (i.e. month and year based on invoice date)

E.g. Invoice E1001 as per GSTR 2A i.e. Supplier records and Invoice F1001 as per Purchaser record but tax values, the month-year combination of invoice date and counterparty GSTIN are exactly matching for these two invoices. Then these two invoices will get reconciled and will move to the Value mismatch category.

If more than one invoice found for comparison then the application will move anyone to Value mismatch category.

We are moving these invoices to value mismatch because invoice value and taxable value is not matching for those invoices.