IRIS GST TIMES

October ,2019

Issue 1

Chief Editor

Vaishali Dedhia

On the occasion of Diwali, We wish for your happiness, peace, prosperity and best of the blessings from Lord Ganesha and Goddess Laxmi.

IRIS GST wishes you a very warm and Happy Diwali.

In this issue, IRIS newsletter covers the details of the new ITC rule – 20% Capping of ITC not reflected in GSTR 2A. furthermore, the edition also features the integration of GST Eway bill with IHMCL FASTag, Single Authority refund Disbursement, updates in CGST rules and India’s first ever Time Release Study.

The feature of the issue is IRIS Sapphire – GSTIN Data Search

Regards,

Team IRIS GST

GST Refund Process with Single Authority Disbursement

In a bid to enable seamless GST refund processing and communication between taxpayers and tax officers, the GSTN portal has been incorporated with an Online GST Refund Processing System. As per the new refund system, the taxpayer shall need sanction order from a single authority to have his refund disbursed, unlike the previous system wherein the orders from the both Central as well as State/UT authorities would be required to sanction the GST refund, which would further slow the process down.

Benefits Of The Online Refund Processing

- Taxpayers and Tax officers will be able to communicate with each other online

- The taxpayer will be notified via SMS and Email at every important stage of their GST refund application

- The taxpayer will be able to keep a track of his GST refund status through the dashboard.

- The taxpayer will be able to reply to any notice received from the tax officer.

Updated CGST Rules, 2017 -The Sixth Amendment

vide Notification No. 49/2019 – Central Tax dated 09-10-2019.

CGST Rule 21A(3) Updated

(Suspension Of Registration)

A registered person, whose registration has been suspended under sub-rule (1) or sub-rule (2), shall not make any taxable supply i.e. shall not issue a tax invoice and, accordingly, not charge tax on supplies made by him during the period of suspension.

CGST Rule 91 Updated

(Grant Of Provisional Refund)

The proper officer shall issue a payment [order] in FORM GST RFD-05 for the amount sanctioned under sub-rule (2) and the same shall be electronically credited to any of the bank accounts of the applicant mentioned in his registration particulars and as specified in the application for refund, on the basis of a consolidated payment advice

The Central Government shall disburse the refund based on the consolidated payment advice issued under sub-rule (3)

Upcoming Due Dates

GSTR 7 – 10th Nov

GSTR 8 – 10th Nov

GSTR 1 – 11th Nov

GSTR 6 – 13th Nov

GSTR 3B – 20th Nov

GSTR 9/9C – 30th Nov

IRIS Peridot against Tax Evasion

- Download Peridot app

- Scan the GSTIN provided on the Invoice

- Check the Compliance status.

- Report any Non-Compliance

You can download IRIS Peridot from Playstore and Apple Store.

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST

20% Capping of ITC not Reflected in GSTR 2A

The central government vide Notification no 49/2019 central tax dated 9/10/2019 has made amendments to CGST Rules, 2017. One of the amendments is insertion of sub-rule (4) to rule 36 which is reproduced as follows:

‘Input tax credit to be availed by a registered person in respect of invoices or debit notes, the details of which have not been uploaded by the suppliers in GSTR-1 ( and consequently does not appear in GSTR-2A) under sub-section (1) of section 37, shall not exceed 20 per cent of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub-section (1) of section 37.’

How The Taxpayer Will Be Impacted By The 20% ITC Rule

After the insertion of this sub-rule, the taxpayers might have to face the following challenges/issues:

- Blockage of Funds

- Following up with suppliers

- Monthly Reconciliation

Open Issues To Be Addressed With Regards To 20% ITC Rule

- Mismatches between GSTR-1 and GSTR-2A – Since GSTR-2A is auto-populated on the basis of the corresponding FORM GSTR-1 furnished by suppliers even after the due date, in such cases there would be a mismatch between the updated FORM GSTR-2A and the actual invoices for a given period, making it difficult to reconcile both.

- Cases where GSTR-1 is filed quarterly by supplier – In case of taxable persons having Turnover less than Rs.1.5 crores, the GSTR-1 is to be filed quarterly. However, since ITC is to be availed each moth in FORM GSTR-3B, it becomes impossible to reconcile monthly invoices with GSTR-2A.

- Calculation problems – The newly inserted sub-rule does not clarify the situations when the supplier reports the invoice/debit note in a subsequent tax period. Whether this amount will form part of eligible ITC for the reported tax period for the calculation of 20% is a question yet to be clarified. Also when the invoices/debit note is reported subsequently, whether the ITC can be taken as credit on FIFO basis or on a pro-rata basis is also to be clarified.

FASTag

FASTag meets Eway Bill

14 October, 2018, two of the major government alliances The Indian Highways Management Company Ltd (IHMCL) and Goods and Services Tax Network (GSTN) have signed a memorandum of understanding (MoU), which focused on the merger of FASTag with GST e-way bill system. Another MoU signed on the day suggest that from December 1, 2019, onwards, the collection of toll charges on any National Highway Toll Plaza shall be carried via FASTag, mandatorily.

What is FASTag

In simple terms, a FASTag is a rechargeable tag that a user can stick on the windscreen of their vehicle. These tags can be detected from 25 metres away using (RFID). Once detected, toll plazas can automatically deduct the toll charges from the traveller’s FASTag wallet, without halting the vehicle for any transaction.

Why Was Time Release Study Conducted In India?

The Time Release Study has been conducted to help officials identify and address the bottlenecks in the trade flow process. This will help the government to make industry-friendly port policies and operational measures. The study was instituted at 15 ports (Sea, Air, Land and Dry Ports) in India, at the same time

FASTag and EWB

FASTag enabled EWB will be mandated across the country from April 2020 onwards. But vehicle owners who are eligible for GST payments need to apply for the e-wallet by December 1, 2020.

With this integration, along with the GST authorities, transporters too, would be able to track their vehicles through SMS alerts that would be generated at each toll plaza.

Benefits of FASTag enabled E Way Bill for transporters/traders

- Precise Transport Monitoring

- Track and Trace mechanism for EWB system

- SMS based Consignment tracking-assistance:

- Cashback on Toll Payments:

- One eWallet, multiple Utilities

- NHAI Prepaid Wallet:

- My FASTag App: Provides a single one-stop solution to FASTag customers. Features include:

- Helps linking of bank neutral FASTag to the bank account of your choice.

- UPI recharge of bank-specific FASTag

- Search for nearby Point-of-Sale location by various banks and IHMCL, List of Operational Toll Plazas under NETC programme, and Customer Support Toll-Free numbers.

- Accidental Death Cover

How to buy FASTag?

A person can buy the FASTag through any nearby POS locations such as Toll Plaza, Partner banks, issuer agencies or online aggregators like Amazon, etc. However, before the FASTag can be put to use, it needs to be activated at any one of the POS by submitting the below-given documents and creating FASTag account.

Key Points

- You need to have separate FASTags for separate vehicles

- In case of loss of FASTag, you can call the issuer agency and block your FASTag. On creation of a new account, your balance amount will be updated in the new account.

FEATURE HIGHLIGHT

IRIS Sapphire: GSTIN Search

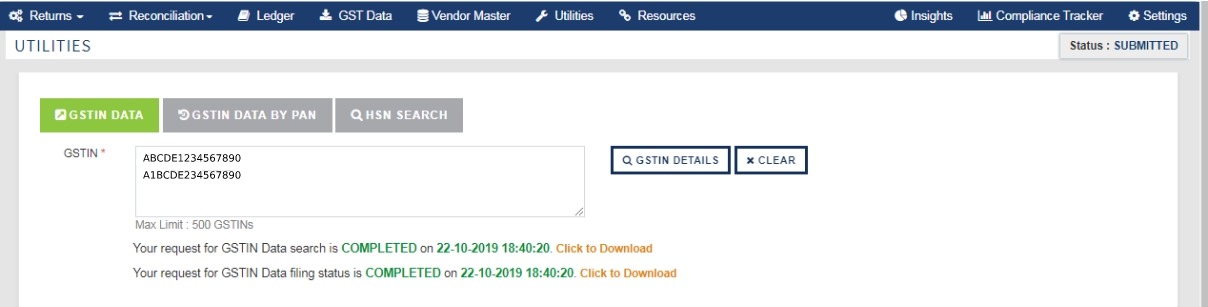

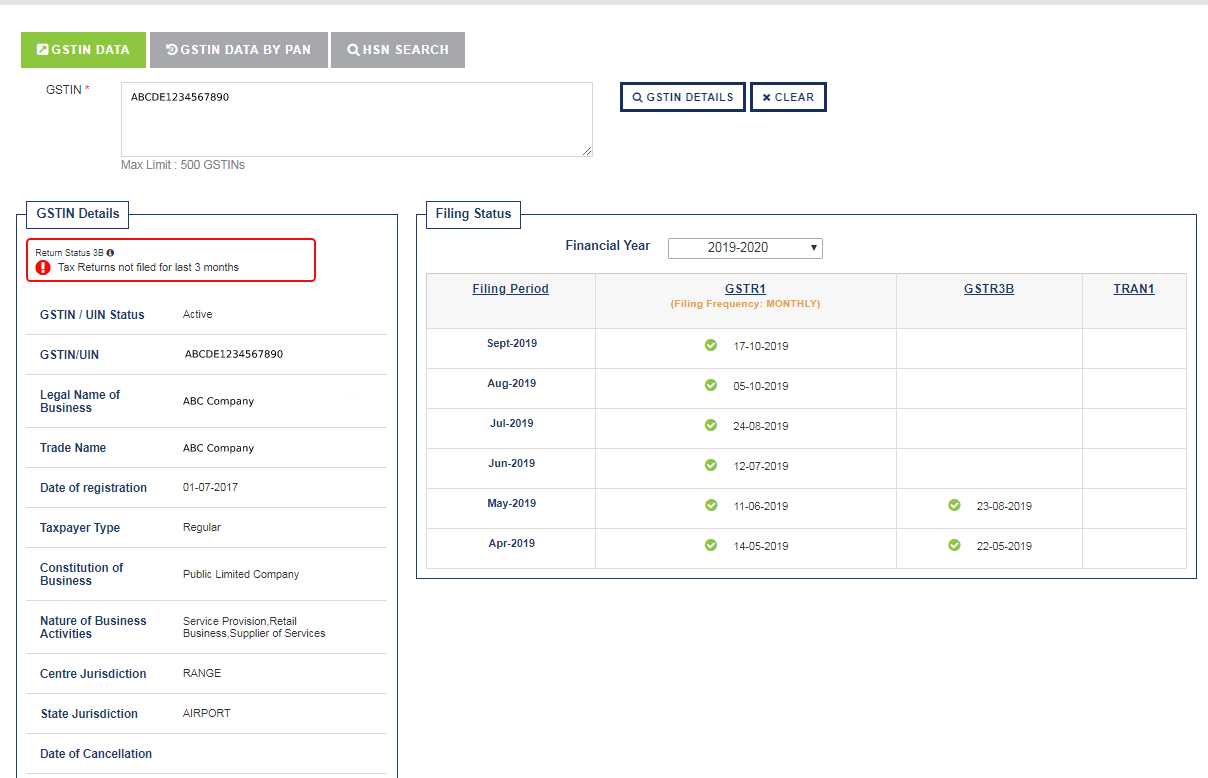

IRIS Sapphire’s utility – GSTIN Data search utility has been updated to provide you with single as well as bulk GSTIN details in one single click.

In order to check the GSTIN details follow the below given steps

- Go to Sapphire > Utilities

- Select the GSTIN Data tab

- Enter the GSTIN

- Click on GSTIN details

IRIS Sapphire will provide you with your supplier’s GSTR 3B compliance status and GSTR1 filing frequency, along with other GSTIN details. Furthermore, you can also check the GSTIN holder’s entire filing history for the selected financial period.

In order to download GSTIN details in Bulk,

- Enter/paste the GSTIN list in the box

- Click on GSTIN details button

- Click on download button to download the CSV file for the GSTIN details

With this utility, user will be able to

- Keep a track of all the Vendors/Supplier’s GSTR 3B and GSTR1 filing and accordingly follow up with vendor who has not filed. This will in turn help to keep a track of provisional ITC claimed which is now capped at 20%

- Help choosing your prospective vendors/suppliers, as well as guide you with your Buyer’s credit management (Non-Compliance is considered to be the red flag to an unstable economy.)

- Avoid getting into business with fraudulent GSTIN holders.

IRIS Sapphire is an application built with a highly scalable, available and secure architecture that will help you to file with GST. With built-in analytics and dashboards, IRIS Sapphire will ensure that you stay compliant, while always having a pulse on the process. Book your free demo today!!!

TRS in India

Time Release Study in India

The Time Release Study (TRS), recognised by World Customs Organization (WCO), is a systematic and standard method to measure the average time taken to release cargoes and for each step or intervention in a border procedure. In an attempt to improve the global trade, India’s first-ever National Time Release Study was conducted by the Department of Revenue, Ministry of Finance. The first phase was held from 1st to 7th August 2019 and the second phase lasted from 3rd – 9th September 2019. Considering its cascading effect on overall global trade of Indian companies, the TRS shall be institutionalized on an annual basis around the same period, every year. This brings us to question and understand the Time Release Study in detail and how can businesses benefit due to the same.

What Is Time Release Study?

Time Release Study, a strategic and internationally recognized tool, is used to measure the actual time required for the release and/or clearance of goods, from the time of arrival at borders until the physical release of cargo. A TRS thereby measures relevant aspects of the effectiveness of operational procedures that are carried out by Customs and other regulatory actors in the standard processing of imports, exports and in transit movements.

Why Was Time Release Study Conducted In India?

The Time Release Study has been conducted to help officials identify and address the bottlenecks in the trade flow process. This will help the government to make industry-friendly port policies and operational measures. The study was instituted at 15 ports (Sea, Air, Land and Dry Ports) in India, at the same time.

Who Will Benefit From The Annual Time Release Study?

The baseline data from the study can be used to determine the efficiency of customs clearance and streamline the border trade process. The expected outcomes include a reduction in the duplication of forms, reduced time and improved system of information sharing amongst agencies,.

Thus, the outcome of the Time Release study will be very beneficial for the export-oriented industries as well as the Micro, Small & Medium Enterprises With TRS in place, the industry will witness standardization of trade processes in the country viz-a-viz international standards.

How Will Time Release Study Help Exporters And Importers In India:

The main focus of the TRS is the clearance time at the border, although it is also applicable to the time required for processes related to documentation & to the time taken for intervention. With TRS implemented at ports as of now, the study will help companies dealing in port transactions. Few ways how TRS will help the businesses:

- Measuring the time taken at various points for the release of goods will help to address the concerns of trade circles regarding long delays in Customs clearance.

- TRS will help companies who are in need of advance planning for the movement of goods across borders in order to meet tight production schedules and just-in-time inventory systems.

- The international trading community assesses the time required to release goods to measure the effectiveness of a Customs administration. A lesser release time will enhance trade relationships of Indian companies.

GST Basics by IRIS GST

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment