IRIS GST TIMES

January ,2020

Issue 1

Chief Editor

Vaishali Dedhia

To the heroes and to the people of our country,

Happy Republic Day!!!

Let’s work together and let’s work hard towards a peaceful and prosperous India!

In this issue, read about the 10 things you should know about the new invoicing system, scheduled to be made mandatory from April 2020. The issue also provides you a year in review for all the major updates in our products.

The feature of the issue is IRIS Onyx – the future proof eInvoicing solution.

Regards,

Team IRIS GST

Tax authorities gear up for first-ever GST Audit

The GST collection has started showing signs of recovery with the monthly collection crossing 1 lakh crore for 2 consecutive months. In order to maintain a stable collection, the finance ministry and GST officials have been taking some strict measures to improve tax adherence and curb tax frauds.

However, it should be noted that despite these measures, the states might still have to face a consolidated revenue gap of over INR 1 Lakh Crores by the end of the transition period, in the year 2022.

Thus, to close the revenue gap, the GST officials have started issuing notices, asking for detailed information on accounts and records for the FY 2017-18. These notices involve 12 sets of documents involving details like of business agreements for sales and purchase, GSTR filing records, Cost audit reports, eCash/credit ledgers, etc.

As per the notices issued, the notified taxpayer is directed to attend in person or through an authorised representative conversant with activities of the firm/company along with following self-attested documents and records required for audit.

GST return form GSTR-3B will now be filed in a staggered manner

In an attempt to de-stress the GST system, the finance ministry on Wednesday staggered last dates of filling GSTR-3B, and has provided three dates for different categories of taxpayers.

Currently, the taxpayers are required to file there GSTR 3b by 20th of every month.

However, with the new staggered filling, the 3 new dates are as follows

20th – for the taxpayers having annual turnover of Rs 5 crore and above in the previous financial year

22nd – for the taxpayers (with annual turnover below 5 crores) from the 15 states/UTs of Chhattisgarh, Madhya Pradesh, Gujarat, Daman and Diu, Dadra and Nagar Haveli, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh.

24th – For taxpayers (with annual turnover below 5 crores) from the 22 States/UTs of Jammu and Kashmir, Ladakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha

Upcoming Due Dates

GSTR 7 – 10th Feb

GSTR 8 – 10th Feb

GSTR 1 – 11th Feb

GSTR 6 – 13th Feb

GSTR 5/5A – 20th Feb

GSTR 3B – 20th |22nd |24th Feb

IRIS Topaz offers you a 360° solution for all your E-way Bill Needs. A cloud-based tool, IRIS Topaz, provides you with the ability to manage all your tasks related to E-way Bill in an easy and automated way, on the go.

Book your free demo for E-way Bill

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST

10 Things to know about the new eInvoicing System

Starting April 2020, the eInvoicing mechanism shall be made mandatory for certain category taxpayers, based on their aggregate turnover. And to help these taxpayers get accustomed to the new system, the option to voluntarily generate and report eInvoice shall be made available for the given category in a phased manner i.e.

- January 1, 2020, for individuals who aggregate a turnover of INR 500cr or more.

- February 1, 2020, for individuals who aggregate a turnover of INR 100cr or more.

10 things to know about eInvoicing

What is eInvoicing?

EInvoicing aka Electronic Invoicing is an electronic authentication mechanism under GST. Under the mechanism,all the B2B invoices generated by a business (agg. turnover >=100cr INR)will have to be authenticated on the GSTN portal, electronically. Furthermore, to manage these invoices, the Invoice Registration Portal (IRP) will issue a unique identification number for every invoice.

Benefits of eInvoicing?

Tax leakage and frauds using fake invoices have been an issue the government is trying to fight even before the GST era. eInvoicing is proposed to put an end to this by mandating authorization of every invoice from the government portal.

Some of the key benefits are:

- One-time reporting of the invoicing details for all your GST filings

- Minimized invoice mismatches during reconciliation

- Standard invoicing system means interoperability between multiple software

- Real-time tracking of invoices prepared by the supplier

- Auto-populated for various GST returns and even EWB (Part A)

- Easy and Precise ITC claim

What software/application can be used to generate an eInvoice?

As opposed to contemporary belief that an eInvoice has to be generated on the common portal, an eInvoice can be generated through any software/tool that supports the given e-Invoicing format.

IRISGST Updates in 2019

IRIS GST – Year in Review

Despite the ever-changing GST system, we at IRISGST have always strived to keep you up to the speed, ensuring your compliance does not suffer. Our product development is agile and we have upgraded the products all the year round as per the changing GST systems.

Not only this, the products have come a far way through the year, all thanks to the constant feedback of our esteemed clients. And what better day than today to abreast you with all that you can do with your IRISGST subscription.

Here’s a list of top updates implemented in IRIS GST compliance solutions round the year

IRIS Sapphire – The GST Software

i. Getting control over your Monthly ITC computation

• Monthly 2A summary:

• Reconciliation Result View for a month:

• Track Invoices for ITC

ii. Verify your vendor’s and customer’s GSTIN

iii. Insights and Reports

iv. Preparing the Annual Return – GSTR 9

• Auto-draft GSTR 9:

• Reports to facilitate GSTR 9 computation

v. EWB-GSTR 1 Reconciliation:

vi. GSTR 3B Auto-Computation

vii. GST returns for other taxpayers type

IRIS Topaz –Eway Bill Management System

i. Email Notification for eway bills needing attention

ii. Set your view preferences

iii. Ease of operation for Consolidated Eway Bills

What to expect in 2020

New year 2020, we anticipate, to be quite happening for overall GST compliance and thus for IRIS GST as well. While our IRIS GST suite will be enhanced to accommodate all the upcoming needs such as e-invoicing and simplified new returns, some things to look forward are

1. IRIS Onyx, our e-invoicing solution, will cater to all the regulatory needs for e-invoicing as well as cater to customer or industry specific needs. IRIS Onyx, will be the one-stop shop for all e-invoicing requirements and designed in a manner which will not disrupt, instead seamlessly co-exists with existing practices

2. IRIS Sapphire will be upgraded to support the new GST returns i.e. ANX 1, ANX 2, RET 1 etc. Beta testing for new returns has been started and some enhancements for reconciliation and ITC claim in 3B are also in pipeline.

3. IRIS Peridot Plus, a premium version of Peridot with features like creating watchlist, getting notifications of filed /not-filed and Peridot Compliance Score are in the roadmap. While this will be a premium version, in the existing free app additional functionalities such as GSTR 1 filing frequency, EWB blocking status will be introduced.

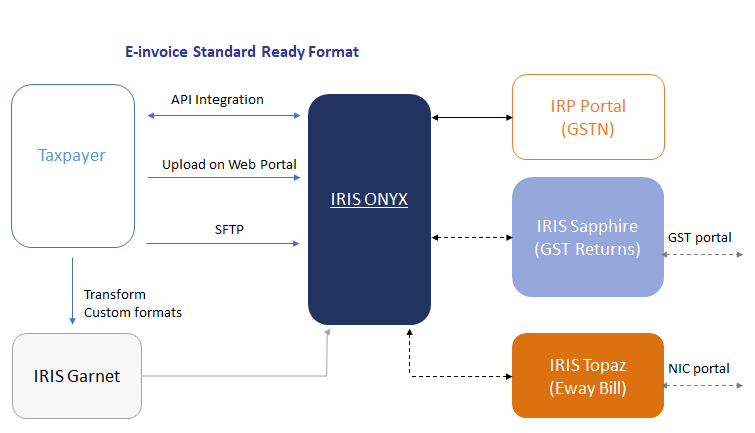

4. IRIS Garnet which is primarily a desktop utility will soon have option to push data directly from the utility to IRIS GST portal. Which means for the routine process of uploading data and ensuring its validated can be managed through desktop utility. Making the upload process automatic through Garnet route is also on the roadmap

Read the complete article here

FEATURE HIGHLIGHT

IRIS Onyx – The future-proof eInvoicing solution

IRIS Onyx is our eInvoicing solution that has been designed to automate and simplify eInvoicing for taxpayers. A cloud based solution, IRIS Onyx helps you generate eInvoice, get IRN seamlessly, bridge the data gap and prepare you for future compliance requirements.

Here is an eInvoice ready format to help you understand the flow of data under IRIS Onyx:

IRIS Onyx provides you with the following features

i. Bulk Upload: Bulk upload and generation IRN

ii. Advanced Validations: *Business rules and advanced or custom validations to ensure data is valid as per Govt prescribed standards as well as your business practices

iii. Invoice Templates: *Customize invoice templates and print and share invoices with customers and vendors

iv. EWay Bill and GST Returns: *Initiate eway bill operations and GST returns filings from IRN

v. Billing Module:* Integrated billing module

vi. PAN Level Operations: Manage multiple GSTINs and locations under GSTIN under single business hierarchy

vii. Custom Views for Users: User roles and access the data view and operations to users

viii. Custom Filters: Set your filters and preferences for viewing and downloading data

ix. Invoice Archiving: Archive for signed invoices for audit and future reference.

To understand about the eInvoicing mandate and know more about our eInvoicing solution.

IRIS Sapphire is an application built with a highly scalable, available and secure architecture that will help you to file with GST. With built-in analytics and dashboards, IRIS Sapphire will ensure that you stay compliant, while always having a pulse on the process. Book your free demo today!!!

Upcoming Updates

Team IRIS GST is working on the following features/updates to provide you with better, efficient and seamless GST experience.

Easyway Bill

Full Truck Load

- Bird-eye view for pending EWB

- Smart EWB expiry alert and easy updations

- Custom watchlist to monitor actions required for any vehicle breakdown, accidents, etc.

- Quick tracking of short distance EWB

- User role management

- Easy EWB data sharing between responsible parties

- Multi-Company/GSTIN access

- Delivery marking for better data management

- Inbuilt GSTIN Compliance checker

Part Truck Load

Apart from the features provided to FTL, PTL transporters will also get:

- Create godowns for each booking or delivery location

- Auto-extension for expiring EWB

- Simple ‘click & create’ option for Consolidated EWB

- Customized and limited access for booking agents or delivery agents

- Smart EWB management

Peridot v3.1

Snapshot

- Ewaybill block status

- Last filed GSTR 1

- UI and Bug fixes

Filing Status

- Group the records financial year wise and sorted in reverse chronological order

- Frequency of GSTR 1

- Inclusion of CMP 08

Peridot Plus

- GSTIN watchlist

- Alerts and Push notifications

- Search by GSTIN (v5)

- Compliance score (v5)

- User Account

Online Garnet

With Online Garnet the user will be able to schedule or manually push data to an ‘SFTP’ location. Once the data has been recieved, IRIS Garnet will check if the data matches the required format, transform the format (if needed) and upload it on our GST portal.

For any error or failure, user will be notified about the same through a detailed email.

IRIS Peridot against Tax Evasion

What can you do against tax frauds, stealing away your hard-earned money?

- Download the Peridot app

- Scan the GSTIN provided on the Invoice

- Check the Compliance status and Filing History.

- Report any Non-Compliance

- Make India a scam-free nation.

You can download IRIS Peridot from Google Playstore and Apple Store.

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment