IRIS GST TIMES

December ,2019

Issue 1

Chief Editor

Vaishali Dedhia

May you be blessed with a festive, loving and peaceful celebration with friends and family, this Christmas and all throughout the year.

Wishing you a Merry Christmas.

In this issue, read about the highlights from the 38th GST Council Meeting. The issue also covers the updates from the recent govt notification on eInvoicing mechanism, how to reset GSTR 3b and upcoming updates in our GST compliance solution.

Feature highlight of the month is GSTR 3B ITC Tracking.

Regards,

Team IRIS GST

How to Reset

GSTR – 3B

Until now, the taxpayer had no option to revise his GSTR-3B details once the files have been submitted. Understanding the inconvenience faced, the Government has enabled the option to reset GSTR 3b.

To reset GSTR 3B, the taxpayer can follow the below-given steps:

- Login to the GST portal and to go to the’ RETURN DASHBOARD’

- Select the year and the month for which you want to reset GSTR-3B

- Click on Prepare Online

- Since the details have been submitted already, the option to reset will be available.

- Click on ‘Reset GSTR 3B’

- Click on ‘Yes’ and ‘OK

Once the taxpayer resets GSTR 3B successfully, he can edit his filing details.

Additional Facilities:

Besides resetting the return details, the new facility also provides the user with the following options:

Preview: for a quick view of the entire form before the form can be submitted.

Initiate Filing: A tax summary screen to check the final figures.

Government to introduce Lottery-based GST Collection

Following a downfall in GST collection, a rise of 1.07 crores was observed in the month of November. This rise was brought on account of the efforts put in by the GST officials to improve tax adherence by the taxpayers. In order to ensure the upward stride is maintained, the government is planning to introduce an incentive-based GST compliance system.

As per the proposed plan, a lottery scheme shall be introduced to lure taxpayers to pay their GST. For the initial period, the GST panel shall hold daily and monthly lotteries for customers who indulge in a B2C transaction and take a copy of the bill after paying applicable GST.

The consumer will be required to upload the bill on a dedicated portal or app(soon to be developed). The app or the portal will automatically capture the phone number, bill number, and GST number of the trader, through which names of the winners will be selected. Once the consensus is reached for the plan at officers-level, it will then be put before the GST Council meeting.

To read more on Lottery-based GST Collection

Upcoming Due Dates

GSTR 7 – 10th Jan

GSTR 8 – 10th Jan

GSTR 1 – 11th Jan

GSTR 6 – 13th Jan

GSTR 3B – 20th Jan

GSTR 9/9C – 31st Jan

IRIS Peridot against Tax Evasion

- Download Peridot app

- Scan the GSTIN provided on the Invoice

- Check the Compliance status.

- Report any Non-Compliance

You can download IRIS Peridot from Playstore and Apple Store.

CONTACT US

Have feedback for us?

Want to request for our product demos? Please reach out to us at

+91 22 6723 1000

support@irisgst.com

@IRISGST

38th GST Council Meeting – Highlights

The 38th GST Council meeting was held on December 18, 2019, under the chairmanship of Union Finance Minister of India, Smt. Nirmala Sitharaman.

Here are the key highlights of Meeting:

Annual Return form – Due Date Extended

The last date to furnish annual return form GSTR 9 and the reconciliation statement GSTR 9C for the fiscal year 2017-18 has been extended to January 31, 2020, from December 31, 2019.

GSTR 1 – Late-fee waiver

In order to improve the GSTR 1 filing, the GST Council has decided to waive the late fee for filing GSTR1 from July 2017 to November 2019, if the returns are filed before January 10, 2020.

However, the EWB generation for a taxpayer who has not filed their GSTR 1 for 2 consecutive filing periods will be blocked

Due Date Extended

For certain North-Eastern States, the due date for filing of few of the GST Returns will be extended amidst the increasing tensions.

Grievance Redressal Offices

Grievance Redressal Committees to be constituted at state and zone level to address the grievances of taxpayers. The committee to consist of CGST officers, SGST officers, representatives of trade and industry and other GST stakeholders like GST practitioners and GSTN etc.

10% restriction on Provisional ITC Claim in GSTR 3B

The GST Council has decided that a restriction of 10% will be applicable on provisional ITC, if the taxpayer’s ITC data does not match with the vendor’s GSTR 1 data. Earlier the restriction was set to 20%. Read more on 20% rule here.

Standard Operating Procedure in case of Non-filing of GSTR 3B

A Standard Operating Procedure (SOP) will be issued for the tax officers to adhere in cases where GSTR 3B is not filed by the taxpayers. The SOP will guide the tax officers in terms of actions to be taken in case of non-filing of returns

E-INVOICING

eInvoicing becomes mandatory w.e.f. April 1. 2020

On 13th Dec 2019, Government notified the e-invoicing rules, its applicability and date from when the notified rules will be effective. In all there were 5 notifications and a summary of notifications is as below

- Getting Invoice Reference Number (IRN)from Government prescribed portal will be mandatory for the notified class of registered person from 1stApril 2020

- All the IRN generation portals will be managed and maintained by GSTN, the IT arm of Government, which is currently maintaining the GST Common Portal

- Registered persons with aggregate turnover above INR 100 crore to obtain IRN for all invoices issued to registered persons

- Registered persons with aggregate turnover above IRN 500 crore should include QR code for all invoices issued to unregistered persons

- Invoices issued by the notified persons as stated above which are not complying with the conditions stated above will not be considered as invoices

While the e-invoicing rules are applicable to certain set of companies and also for certain type of transactions, we recommend while making any changes to existing systems and while defining the standard practices for invoice generation and printing, a holistic and futuristic approach to be taken. Flexibility and provision to cover all transaction types and all document types, if considered in the IT systems now, adapting to future changes in the e-invoice mandate if any, will be quick and hassle-free.

Government is getting the IRP system up for testing and in parallel is holding workshops for various stakeholders across the country. The API specifications are expected to be released during 3rd or 4th week of Dec 2019. IRN generation through API is most likely to be via GSPs. We’ll keep you posted about the latest developments.

IRIS is one of the established ASP-GSP solution provider for GST compliance as well as Eway Bill Generation. For e-invoicing, our approach will be make transition and integration with minimal changes in the data requirements.

FEATURE HIGHLIGHT

IRIS Sapphire: GSTR 3B ITC Tracking

With the implementation of restricted provisional ITC rule, it is important to track the invoices in order to maximize your ITC claim.

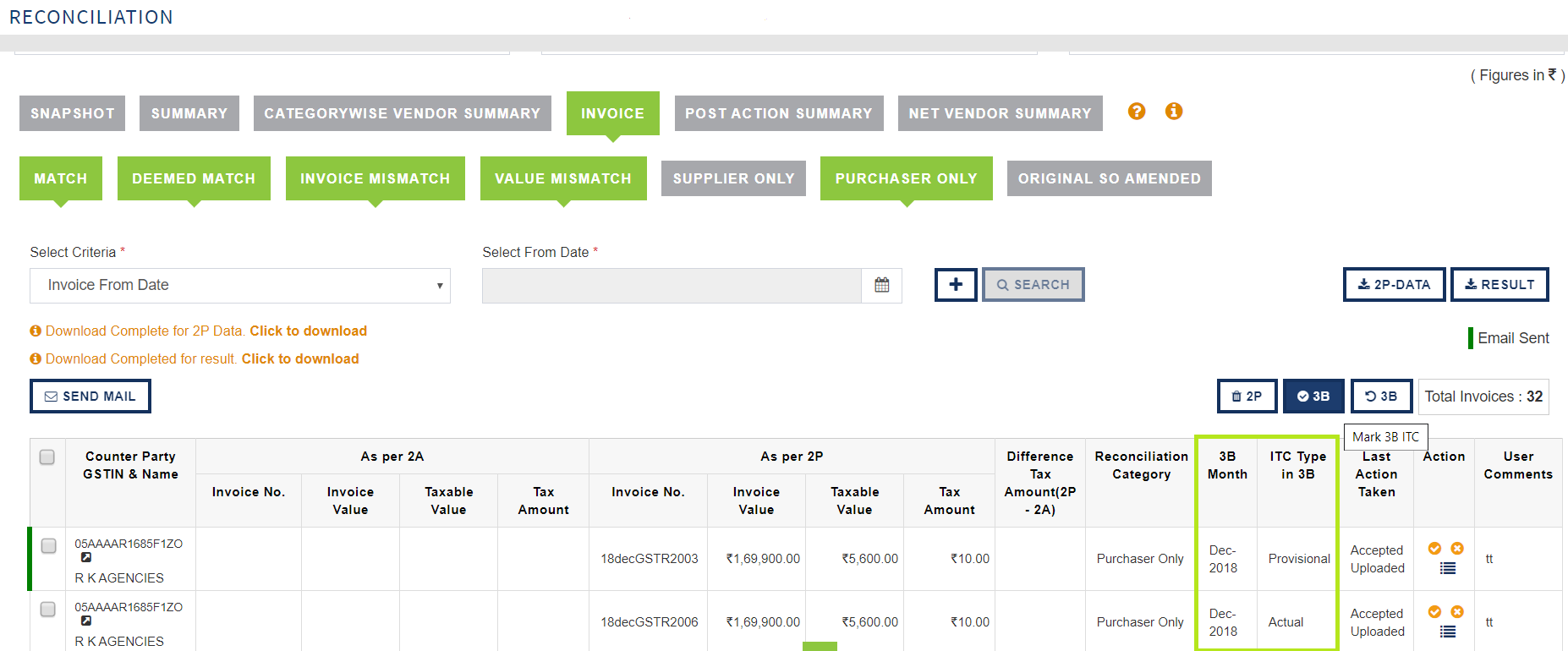

In order to help you with the same, GSTR 3B ITC tracking feature has been introduced in IRIS Sapphire’ Reconciliation module in all the categories (Except Supplier only category).

Mark 3B ITC:

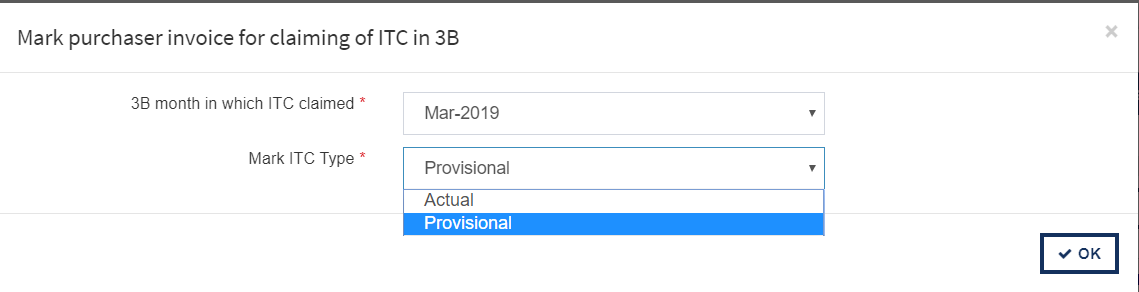

In order to mark your 3B purchaser invoice, select invoices on which you want to claim the provisional ITC and click on “Mark 3B ITC”.

A dialog box will appear, wherein the user has to select the month for which the ITC has to be claimed in 3B and mark the ITC as Actual or Provisional.

The user can also filter out provisional or actual ITC marking invoices as per the requirement. The new columns for the feature are related to 3B ITC claimed for a given month and ITC Type in 3B. These columns have been added in downloaded records for 2P data and in reconciliation results. ITC marking button for reset 3B is also available.

The feature of ITC marking is set to ease your ITC calculation for GSTR 3B purpose.

IRIS Sapphire is an application built with a highly scalable, available and secure architecture that will help you to file with GST. With built-in analytics and dashboards, IRIS Sapphire will ensure that you stay compliant, while always having a pulse on the process. Book your free demo today!!!

Upcoming Updates

In an endeavour to keep you up to the speed of all the recent updates and amendments, our team at IRIS has developed the following features in the month of December.

IRIS Sapphire

GSTR1 Duplicate invoices check:

The utility allows the user to scan the invoices uploaded in GSTR 1 and notifies them for any duplicate invoices. Also, structural validation has been added to catch duplicate invoices in the uploaded data.

Ledger Balance:

A new option has been added in Sapphire that allows the user to fetch ledger balance of selected GSTINs. The balance fetched will always be as on current date.

Reconciliation (Supplier only Category):

With this feature, the user will be able to keep a track of all the records that has been amended, even if the original invoice is in some other GSTIN of same root PAN.

GSTR6 Bulk Upload:

A bulk upload utility has been added for GSTR6.

Reconciliation (Delete 2P):

A Delete 2P feature has been provide to our reconciliation module. Once the user deletes a 2P invoice, the corresponding 2A invoice(s) is moved to supplier only category.

Reconciliation (Delink and delink history):

The Delinking feature will undo reconciled records and re-categorize those invoices to Purchaser Only and Supplier Only buckets respectively. History of such delinked invoices will also be maintained and will be accessible on Reconciliation>Results>Delink History.

Consolidated Recon Result Download(B2B & CDN combined): User will now be able to download consolidated recon results of both the sections in a common csv format. This feature is accessible from bulk download page.

Webinar – How to Get Ready for the e-Invoicing Mandate

As per notification 68/2019 – 72/2019 issued on 13 December 2019, the eInvoicing system takes effect from April 2020. To ensure a smoother transition, the eInvoicing system is made available on a voluntary basis from January 1, 2020 for businesses with aggregate turnover >500 crore and from February 1, 2020 for businesses with aggregate turnover >100 crore. With just a few days to go, it is essential that you and your team are accustomed to the ways of the new invoicing system.

To help you prepare for the new e-Invoicing system.

Disclaimer: IRIS Business Services has taken due care and caution in compilation of data. Information has been obtained by IRIS from sources which it considers reliable. However, IRIS does not guarantee the accuracy, adequacy or completeness of any information and is not responsible for any errors or omissions or for the results obtained from the use of such information. IRIS especially states that it has no financial liability whatsoever to any user on account of the use of information provided.

Leave a comment